The potential of Electronic Funds Transfer (EFT) ultimately depends on extensive networking between computer systems. The mainframes and computers within banks, government agencies, the Federal Reserve and other central banks, and the corporations involved in EFT had to be digitally linked before electronic payments could become feasible. Of course, this networking to create a wired society is exactly what has been happening over the last thirty years. The technology was really quite revolutionary, even though such capabilities might seem common-place today. The availability of inexpensive computer systems combined with extensive networking eventually made EFT accessible even to the smallest of businesses and individuals.

The potential of Electronic Funds Transfer (EFT) ultimately depends on extensive networking between computer systems. The mainframes and computers within banks, government agencies, the Federal Reserve and other central banks, and the corporations involved in EFT had to be digitally linked before electronic payments could become feasible. Of course, this networking to create a wired society is exactly what has been happening over the last thirty years. The technology was really quite revolutionary, even though such capabilities might seem common-place today. The availability of inexpensive computer systems combined with extensive networking eventually made EFT accessible even to the smallest of businesses and individuals.

For instance, anyone starting a web-based business today can quickly set up an electronic purchasing system that allows customers to buy goods and services entirely through the Internet without sending in checks or issuing paper invoices. Amazon was a major trail blazer in this regard and literally millions of other web-based businesses have followed suit. Even brick and mortar businesses have a plethora of choices available when it comes to setting up electronic payment systems using computerized cash registers with wired links for card-based purchases. It is through these vast electronic networks that link every computer and mobile device throughout the world which will ultimately birth the most elaborate economic system ever devised. The wired society that is now in place will soon allow the Antichrist’s system and the Mark of the Beast to become feasible and operational exactly as the Bible predicts.

Over the last few decades, the banking industry combined with governments and corporations around the world have provided the basic infrastructure required to make EFT the standard payment system for the future. The U.S. is divided into territories with regional switching points to handle this flow of electronic information. Automated Clearinghouses (ACH) have been set up across the country to replace the traditional check clearing process. According to NACHA, the Electronic Payments Association, the total ACH volume exceeded 21 billion transactions in 2012, constituting nearly $37 trillion in transfers over the network. Similar systems exist throughout the world, especially in Europe and Japan.

Instead of manual operations as was done in the past where banks would physically exchange the paper money and checks needed to settle their accounts, electronic clearing houses are specifically designed for full EFT in a cashless and paperless process. The ACH switching points provide completely automated systems with a total elimination for the physical movement of currency. Nothing but electronic bits of information traveling through the network and crediting or debiting the appropriate accounts makes the whole process operate.

Other complementary systems important for interbank electronic communications have sprung up as well, such as the Fedwire and Bank Wire networks. The Fedwire is set up between the Federal Reserve in the U.S. and its member banks for message transmission and funds transfer. The Federal Reserve is the controlling central bank of the U.S. banking industry, and its EFT capabilities are essential for the smooth operation of the entire financial system. Money and credit are created by fiat by the Fed and managed through their member banks; thus, they are also the central governing power in interbank transactions within the U.S. The Fedwire system is set up for large value transfers among the more than 9,289 participating banks and financial institutions. Over $2.7 trillion in funds are electronically transferred through this network every day, representing over 537,000 settlement payments occurring on a daily basis. The annual value of all transfers between banks using Fedwire during 2007 was over $631 trillion or almost 40 times larger than the entire U.S. economy!

A similar financial EFT system, the Bank Wire network, is controlled by the Payment and Telecommunications Corporation and was set up by a number of national banks. It is mainly a medium of confidential information exchange, replacing the old method of sending letters or documents through the mail. Thus, the entire U.S. financial industry is electronically linked together and fully operational, sending through wired and wireless communications networks massive amounts of information and currency transactions. In addition, this system maintains records on every transaction within computer databases that keep track of virtually the entire American financial industry.

Europe is also treading down a similar path toward electronic buying and selling. The European GIRO system is a classic case in point. Its name comes from the Greek word “gyros” which relates to a circle. The GIRO electronic payment system therefore relates to the “circulation of money”, and customers most often experience it in a service that most European banks offer their account holders for the transfer of funds. The system is widely used to pay revolving or recurring payments such as mortgages or utility bills. This particular form of EFT is referred to as a credit EFT system, and the GIRO network and others systems similar to it have become the most common way that personal electronic payments are made, because the usual check mailing process of paying bills is bothersome to most people. It probably won’t be too long before both individuals and businesses make all of their payments exclusively through EFT. In fact, it may become mandatory to use EFT instead of cash or checks in the near future, as the cost savings alone will justify the switch. From these developments, it appears that the age of check writing could come to an end sooner than we think, which brings the world one more step closer to the elimination of cash along with the coming of the Mark of the Beast.

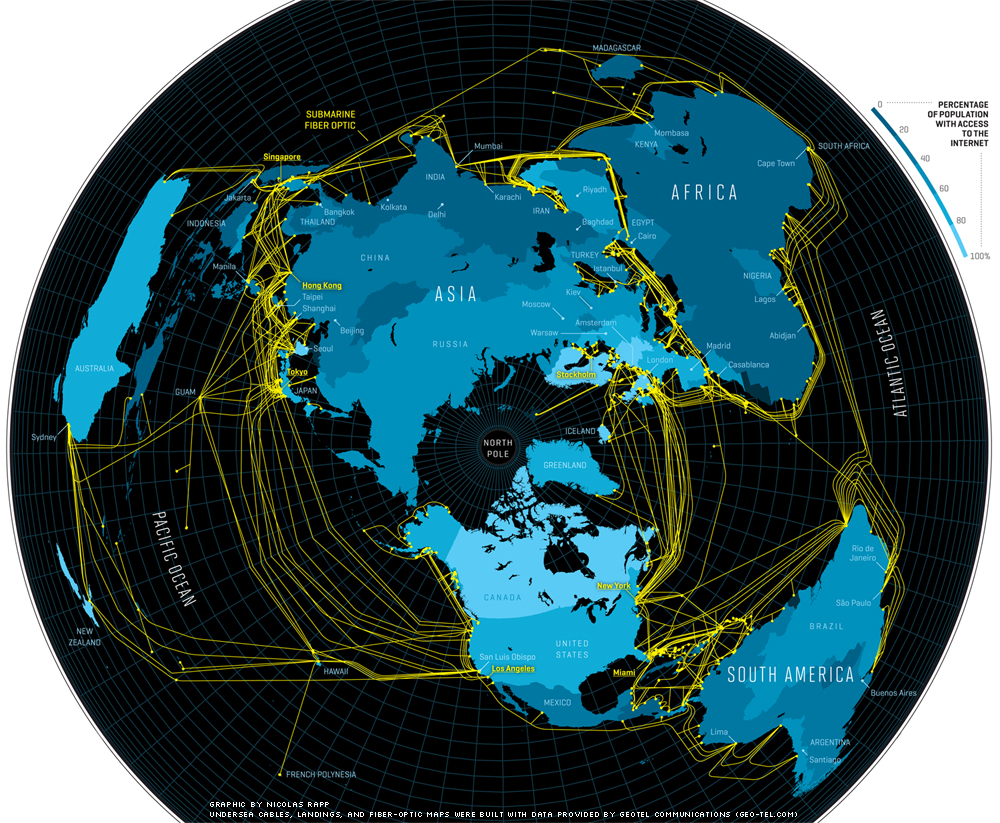

On the international front, the EFT networks are coming together throughout the Western Alliance and the rest of the developed world. To help in this consolidation, the Clearing House for Interbank Payments Systems (CHIPS), a private network, was created solely to handle worldwide electronic transfers between member nations (The Cashless Society: EFTS at the Crossroads, August Bequai, p. 10, 1981). Since every country or region within the Beast’s empire has been developing their own internal networks having similar capabilities to the U.S. and European systems, establishing standardized communications between each region has become an absolute necessity. In the book Microelectronics and Society, the Club of Rome has said,

“…the need for rationalization among the various approaches to the main electronic goal is great if advantages associated with the new technologies are to be realized” (p. 69; emphasis mine).

By 1983, after only thirteen years of operation, the CHIPS network was handling over $200 million per day in international electronic funds transfers between nations (Microelectronics and Society, p. 69). Today, CHIPS networks are used to settle over $1 trillion in transfers every day, which represents over 250,000 interbank payments per day (for additional information on these networks, see the Federal Financial Institution Examination Council (FFIEC) InfoBase at http://ithandbook.ffiec.gov/).

Another similar electronic system called the Society for Worldwide Interbank Financial Telecommunications, or SWIFT, actively competes with CHIPS and may eventually become the major international clearing house (http://www.swift.com/). Headquartered in Brussels, it was originally set up to be the EFT switching mechanism between the United States and Europe. However, SWIFT is now expanding into all parts of the world. By 2010, over 9,000 banks and financial institutions in 209 countries or territories subscribed to its services. The network now handles over 15 million electronic transmissions between member institutions every day. As if to foreshadow things to come, there is even a rumor that the computer system that handles SWIFT’s operations has been nicknamed The Beast.

Networks provided by organizations like CHIPS and SWIFT have resulted in the formation of a vast, one-world electronic financial system. This now allows EFT to function between every country on the globe. Walter Wriston of Citibank was quoted as saying,

“Whether we like it or not mankind now has a completely integrated, international financial and informational marketplace capable of moving money and ideas to any place on this planet in minutes” (Money Lenders, Sampson, p. 23).

The phenomenon of EFT in the banking and financial industries is only one step on the way toward a totally computerized and cashless society. The foundational networks now being laid between governments and their money handling entities will soon lead to an elaborate system which will affect all of our lives. The standardization of these financial networks between all nations has lead to a common international financial structure that soon could consolidate into a global currency run by a global bank. The Club of Rome predicted where all this would lead in 1983:

“It can be suggested that we are entering a period of deep transition which may last from thirty to fifty years before leading to a completely different type of world society” (Microelectronics and Society, p. 20).

The change that has come upon the world economic system is so dramatic that if a person could be transported from 50 years ago into our EFT future; he likely would be shocked by how different our society has become. The Club of Rome also said,

“The evolution toward a cashless (and increasingly checkless) society, where the flow of money will turn into a flow of electrons around the circuits of computer networks will radically affect not only the organization of bank services but commercial services as well” (Microelectronics and Society, p. 142).

Today, EFT systems allow payment card transactions using credit and debit cards, direct wire transfers of funds between companies and individuals, direct deposits into savings and checking accounts, electronic buying and selling of stocks and bonds, direct payments through electronic checks, online banking, e-commerce using online purchases, and even new completely electronic mediums of currency (such as Bitcoin). The electronic networks that make all of this possible are designed to allow the economic system of the Antichrist to operate immediately upon his rise to power. When the edict for the Mark of the Beast goes out to the entire world, all of the systems will be in place and poised to begin the process at a moment’s notice. Those in control of these systems and networks will ultimately control the lives of billions of people.

Next: ATM and POS